loading...

- 香港脉搏首页

- 每日专题

- 财金博客

- 理财/管理

财金博客政政经经美3月CPI爆表作者介绍

作者为资深投资者。

昨(11日)文已预期美3月CPI爆表,果如是,预期是基于美通胀有3个主要推手:

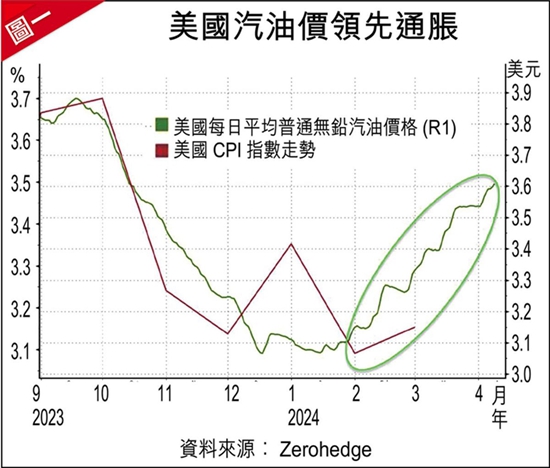

1. 油价,特别是油站汽油价;

2. 屋租;

3. 就业和工资。

昨文只谈油价,这是显而易见的,只要细观察便知(图一),图一是有下文的。油站油价资料是至4月,升速远抛离3月所报的通胀数据。到报4月通胀数据时,会将这个抛离补回来,即是4月通胀(在5月公布),在这项目是会升的。

美通胀升出乎预料

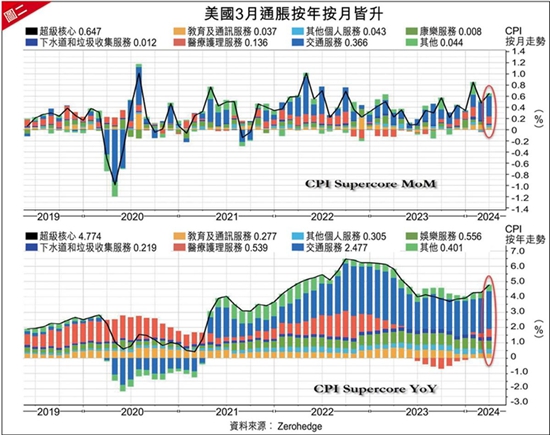

3月美通胀爆升,还有个更深层意义,因为这个通胀是月比、年比都升(图二),是出乎市场预料。为什么这次超出预料是重要?彭博的经济师Anna Wong有这评语:

“March is a month where the CPI enters a seasonal window that's favorable for disinflation. The fact that core CPI remained the same in March as February-even if it maps to about 0.3% in core PCE inflation terms - is not a good development. This report more than February's is likely to feed Fed concern that progress on disinflation is stalling-even though the core print for the two months was the same。”

简言之是:3月是季节性上有利通胀回下,但当通胀应跌而不跌,可能反映通胀已止跌。

彭博的息率策略家Ira Jersey则谓:

“The 3-month annualized core CPI climbing to 4.5% is going to keep early Fed-cut calls muted coming up. 50 bps of cuts in 2024 currently being priced may not occur until later in the year. The yield curve flattening isn't surprising as we continue to price out early and deep cuts。”

“The timing of 2024 rate-cut expectations are front of mind for market participants with linear markets pricing just below even odds of a first cut in July. Still the stickiness of 'supercore' inflation now north of 8% on a 3-month annualized basis may continue to put upward pressure on expectations of the Fed's terminal floor。”

“A retest of 4.51% is nearly assured with the higher-than-expected CPI. If that doesn't hold 4.7% is the next stopping spot for the 10-year yield。”

简译过来是一句:息升啦!

她更指出(警告?)10年美债息会见4.51%,如仍不止于此水平,便会上见4.71%。4.51%和4.71%的10年债息是什么样水平?看图三。

10年债息高企,会启示什么?以后谈,今时只讲一句,投资要谨慎,准备息升!

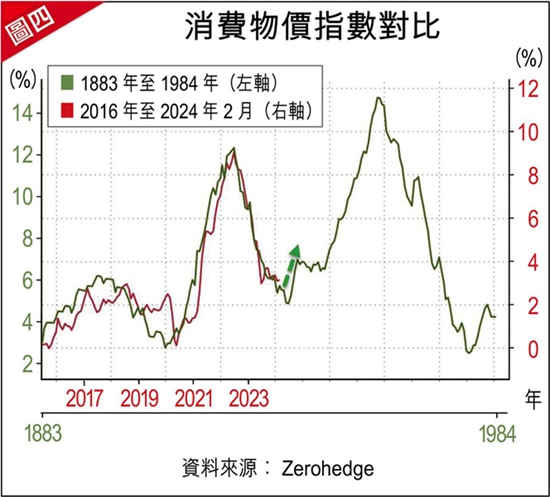

图四是美通胀N年来统计下来的历史走势,于3月22日《鲍鹰变鲍鸽》一文及昨日《美CPI回升?》文刊出过。此图值得各位剪存,并将以后的美通胀数据补上,看历史会否重复,可及时布置好自己的资产。

投资涉风险,每位投资者承受风险程度不一,务必要独立思考。笔者会因应市况而买卖。

《经济通》所刊的署名及/或不署名文章,相关内容属作者个人意见,并不代表《经济通》立场,《经济通》所扮演的角色是提供一个自由言论平台。

分享:返回政政经经其它政政经经文章- ·等看美以出丑

- ·IMF会埋葬美元?

- ·美3月CPI爆表(本文)

- ·美CPI回升?

- ·厉害过巴菲特的贝莱德

上传图片仅支持JPG、GIF、PNG图片文件,且文件小于5M

上传图片仅支持JPG、GIF、PNG图片文件,且文件小于5M

(点击用户名可以查看该用户所有评论)  只看作者评论

只看作者评论

查看全部评论:↑顺序 ↓倒序

查看全部评论:↑顺序 ↓倒序

- 暂无读者评论!

查看全部评论:

↑顺序 ↓倒序

查看全部评论:

↑顺序 ↓倒序

- 财金博客

- 理财/管理

- 健康人生

- 时尚艺术

- 吃喝玩乐

- 全部

- 财金博客

- 理财/管理

- 健康人生

- 时尚艺术

- 吃喝玩乐

- 全部

- 陶冬天下 • 陶冬9542192

- 运筹帷幄 • 梁业豪025090

more on Column

more on Column- Features 每日专题

专题

财金博客

陶冬 陶冬天下 李迅雷 李迅雷

陈永陆 陆言堂 黄玮杰 师傅教路

罗国森 品中资 林家亨 股林淘金

胡一帆 全球视野 潘铁珊 投资心得

朱红 权证红盘 郭思治 思前想后

陈其志 牛熊志选 温灼培 真知灼见

梁业豪 运筹帷幄 熊丽萍 缸边丽评

张赛娥 娥姐锦囊 温天纳 融天纳地

黎伟成 谈国论企 邓声兴 投资智慧

姚超文 宝岛热话 魏东 洞析楼市

石镜泉 政政经经 范强 范强 - 理财/管理

【FOCUS】

罗国森 我要退休

李锦 亲子理财

唐德玲 女子爱财

汪敦敬 楼市点评

黄美云 玄来更精彩

Jimmy Leung 改朝换代Digital

Michael & Derek 我做Marketing

管理·创业

沪深港通

国际动态

曾智华 快乐退休

伍礼贤 经济不停学

方展策 智城物语

梁子骢 Brian 销售达人

张少威 威少看世界

张翠容 容我世说

雷鼎鸣 雷鸣天下

李慕飞 港是港非

- 健康人生

健康解“迷”

曾欣欣 欣欣Super Food

陈沛思 食疗新意思

谭莉英 美女中医

Oscar治疗师 都市痛症

李美怡 Cathy Lee 素食厨房

古锦荣 性治疗师手记

云无心 健康朝九晚五

陈涌 健康“肤”识

黎凯欣 照顾者手记 - 吃喝玩乐

食得喜

旅途中

通通 吃一吃

主教练 足球俱乐部

Saii Lee “世”界味觉之旅 - 时尚艺术

妮洛 港女讲男

傅雪峰 慧眼识车

Ivan Lau More Than Fashion

Nadia Tang 时装延想

汝勤 The Dapper Style

Ayu 阿愚 我单身但我快乐

Wayne Hui 寻宝人

编辑爱美丽

费吉 古董投资秘笈

赵健明 Janice Chiu 建筑·艺术·远方

Kogi Ko 寻宝女生日志

一个月内新增栏目北京港经通经济信息咨询服务有限公司上海分公司

一个月内新增栏目北京港经通经济信息咨询服务有限公司上海分公司

经营许可证 : 沪ICP备17049915号-2 沪公网安备 31011502014598

未经许可,不得转载

沪公网安备 31011502014598

未经许可,不得转载

举报邮箱:etnetchina_cs@etnet.com.hk 举报电话:8008200908

中国互联网联合辟谣平台 中国互联网举报中心

免责声明:经济通有限公司及/或第三方信息提供者竭力确保其提供之数据准确可靠,惟不保证该等数据绝对正确。 - 财金博客